GST E-Way Bill GST E-Way Bill

All You Need to Know about E-Way Bill!

Well! GST has already grabbed attention of the entire nation, and now with another bill under this regime has been passed off lately. Yes, the title says it all; we are talking about the E-Way Bill that has been issued for any transportation of Goods with a batch value of more than INR 50,000 (Indian Rupees Fifty Thousand Only). Or, in layman’s language, we can say it is an electronic way bill for the movement of goods.

The movement of goods can be generated on the common portal that is GSTN. The movement of goods (with a batch value of more than INR 50,000) is not really possible without an e-way bill of a registered person. Although the bill can easily be generated or cancelled through SMS; a unique E-way Bill number is generated for the identification purpose and is immediately available to the respective supplier, dealers or the recipient.

Generation of E-Way Bill

All the transport dealers, suppliers and people related to the transportation industry need to be well-aware about the E-way Bill. The bill needs to be generated whenever there is a movement of goods in batch of value of the said amount.

The E-Way bill is generated in relation to any supply (as earlier stated, batch supply of over INR 50,000), or maybe other than a supply (it could be a return or the transfer of goods located in one place to another) and in the scenario due to the inward supply from an unregistered person (purchase of goods from an unregistered person with a value of more than the above stated amount).

Supply under E-Way Bill

In simpler terms, supply, here, means the sales of goods, be it transfer (branch transfer from one location to another), barter or exchange. Under this bill scheme, a supply may be:-

- Supplied for a consideration in the course of business

- Supplies made for a consideration, which may not be in the course of business

- Supplies without consideration (without payment)

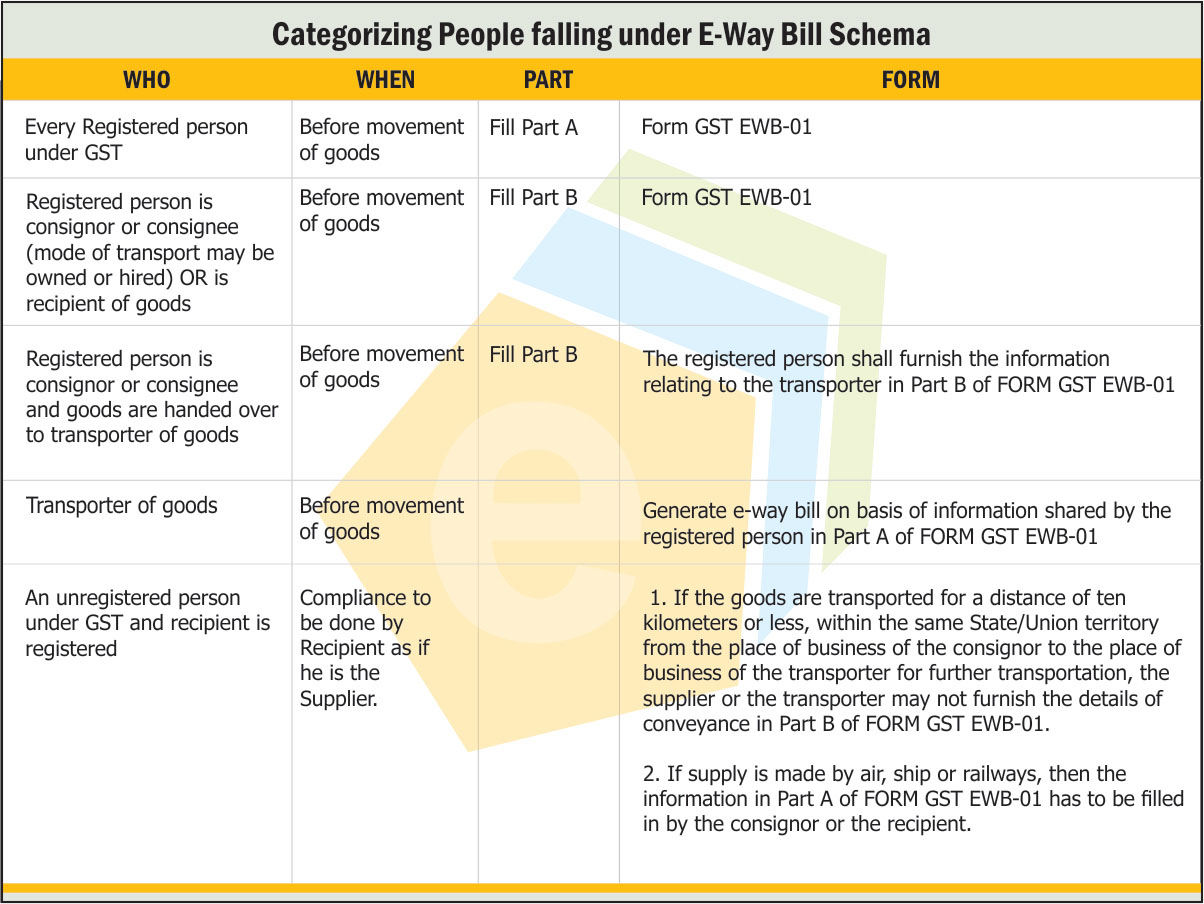

Categorizing People Falling under E-Way Bill Schema

Generation of E-Way Bill Number (EBN)

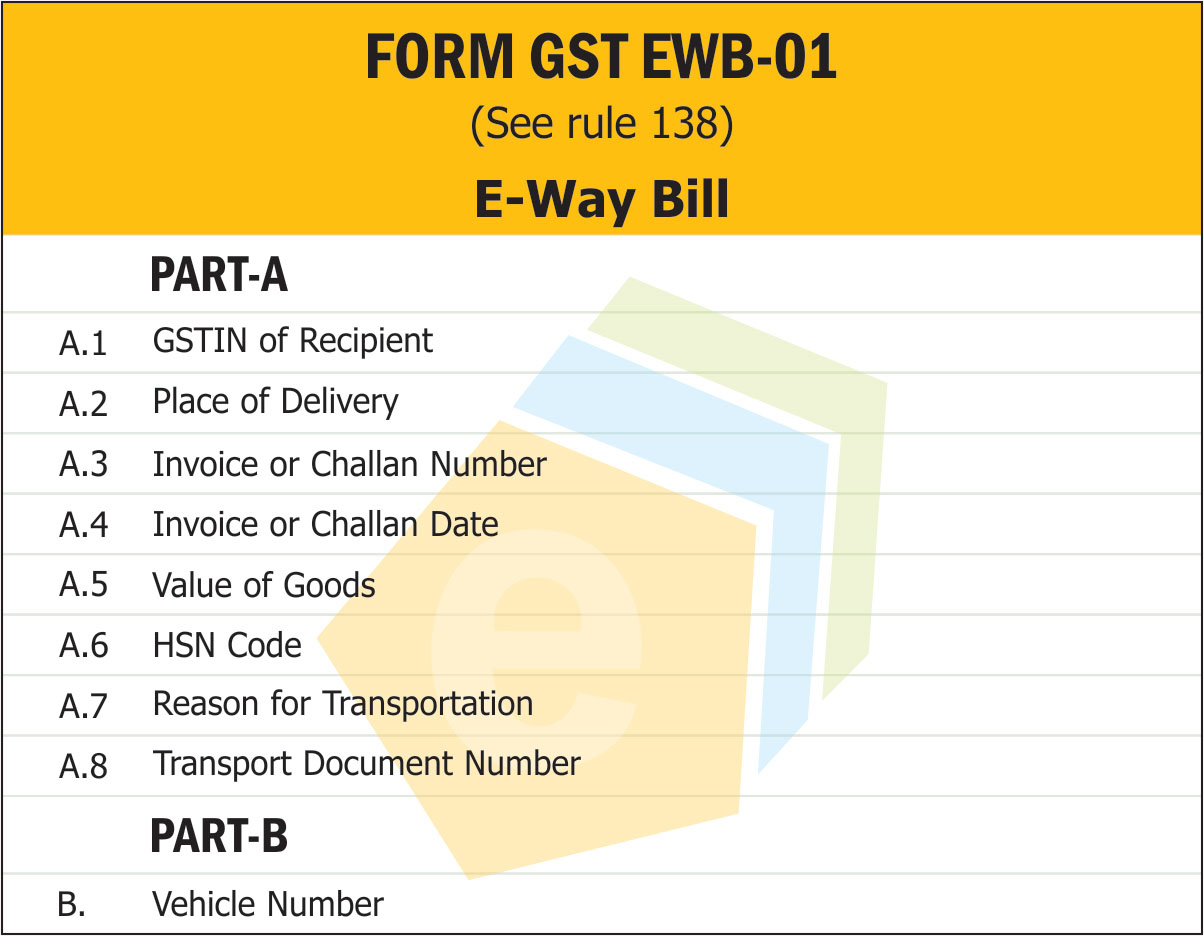

A taxable user registered under GST or an unregistered user or a transporter can easily generate E-way bill over the GST portal. A person needs to fill and submit certain necessary documents on the GST Common portal in FORM GST INS-01, in this way a inimitable e-way bill number (EBN) would be generated and will be provided to the supplier, receipt & transporter.

Any registered taxable user would be instantly intimated about the e-way bill or the issued EBN on the common portal. The portal provides the choice to accept/reject the consignment that has been covered under the e-way bill. If no communication is being initiated about the acceptance/rejection from the registered user within 3 days, then the bill would be considered as accepted. At the end, accepted bills would be reconciled on its own on GSTR-1 during the monthly GST Returns filing.

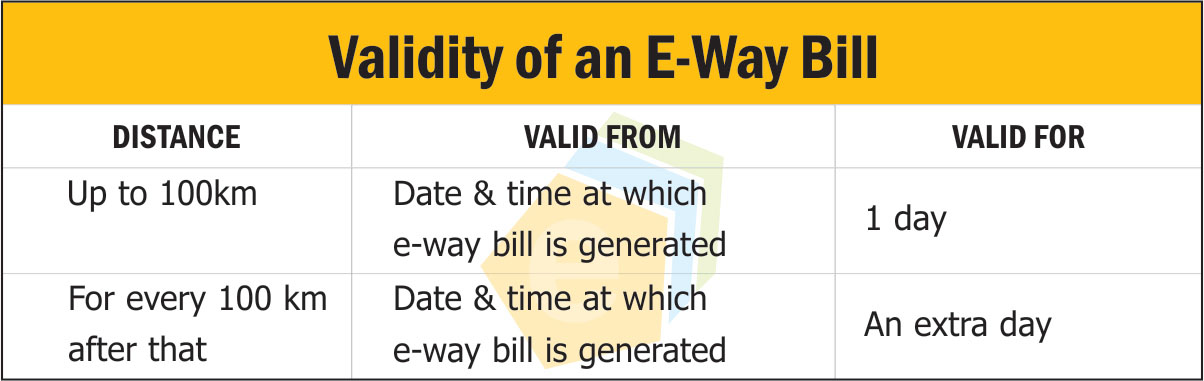

Validity of an E-Way Bill