Mixed Reactions on the 23rd GST Council Meet in Guwahati!

Guwahati witnessed the 23rd GST Council meet held by GST Council on 10th November 2017. Let’s scroll down to have a glance on some of the vital updates from the meet up:

Composition Scheme - The Amendments:

- For manufacturers & traders 1 % would be the GST Rate

- Limit for the Composition Scheme to be increased to Rs 1.5 Crore although can be extended to Rs 2 Crore later.

- 1% Composition tax on turnover of Taxable Goods; turnover of Exempted Goods to be excluded.

- Those supplying Goods and Services (services not exceeding Rs 5 lakhs in total) eligible for compositions scheme

- Extension of Composition Returns, GSTR-4 due date to 24th December

- No to inter-state sales for Composition dealers; Input tax benefit not allowed.

GSTR Compliance - Giving a Sigh of Relief:

- GSTR-1 and GSTR-3B to be filed by all businesses till March 2018.

- Committee of Officers will work out for the GSTR-2 and GSTR-3 filing dates for July 2017 to March 2018.

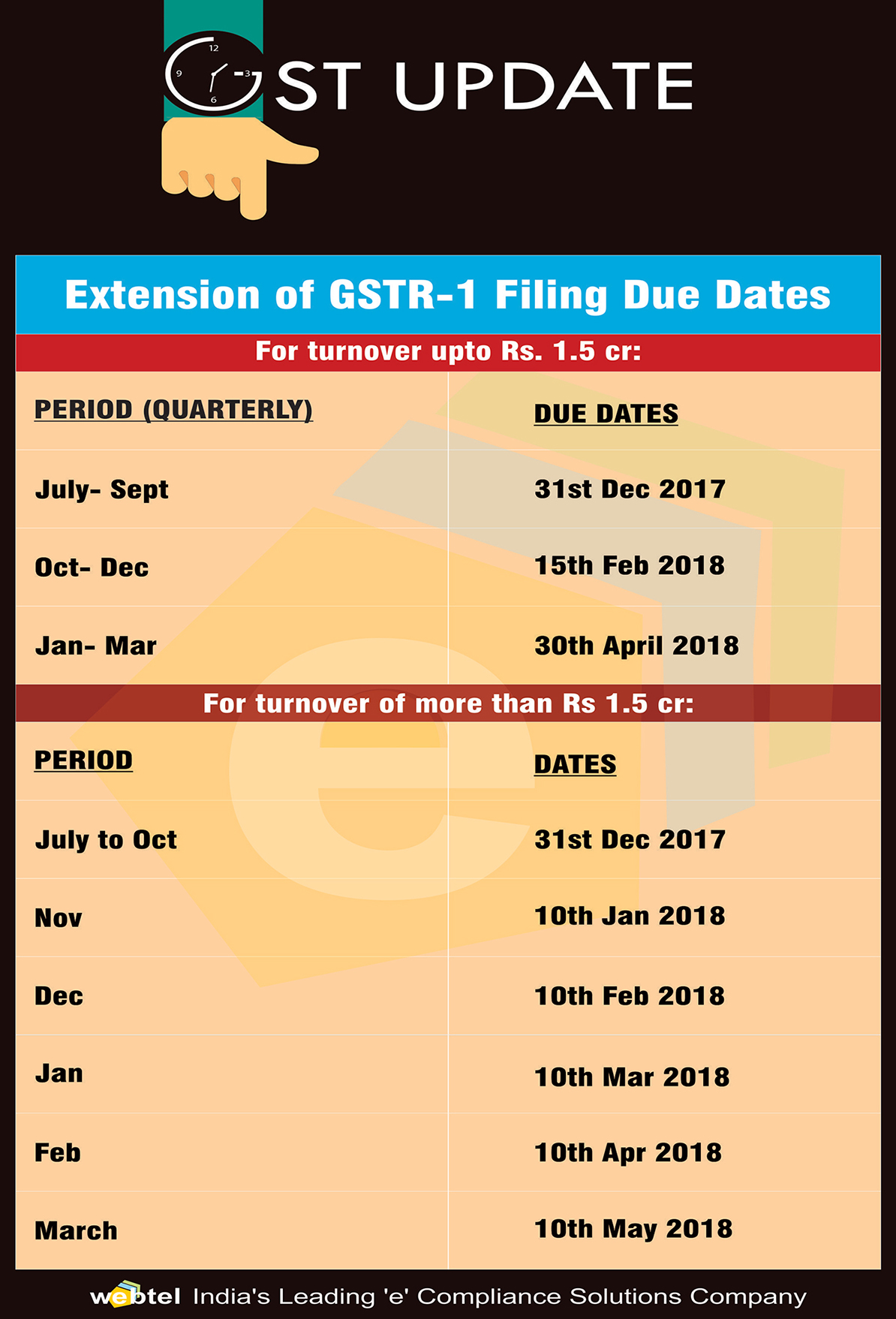

- File Quarterly GSTR-1with turnover under Rs 1.5 Cr

- File Monthly GSTR-1 with turnover above Rs 1.5 Cr

- GSTR-3B to be filed by all businesses by 20th of next month till March-2018.

Relief for Service Providers: All service providers with turnover up to Rs 20 lakhs exempt from GST registration. Including those who supply inter-state or supply through e-commerce operator, such service providers do not have to register.

Challenges for Restaurants with 5% GST rate cut with no input tax credit.

Other Taxpayer Relief Measures:

- Reduction in the Late Fees– Reduced from Rs 200 per day to Rs 20 per day in caes of delay in filing of NIL returns.

- Credit on Late Fee– Penalty has been waived off for GSTR-3B of July, Aug and Sept. And if paid for these months, it will be credited back in Electronic Cash Ledger under 'Tax' that can be consumed to make GST payments.

- Introduction of Manual filing for Advance Ruling application

- Exemption from GST on Export of services to Nepal and Bhutan, allowing to claim a refund of input tax credit paid, if any.

- 31st December 2017 to be the last date for filing and revision of TRAN-1. Revision to be done only once.

- Timelines for filing of GSTR-2 and GSTR-3 for July to March 2018 to be worked out by Committee of Officers. However, subsequent month filing of GSTR-1 will not be impacted.

Others GSTR filing Due Dates Extensions:

| Return |

Revised Due Date |

Old Due Date |

| GSTR-5 (for Non Resident) |

15th Dec 2017 |

Earlier of 20th August 2017 or 7 days from date of registration |

| GSTR-4 (for Composition Dealers) |

24th Dec 2017 |

18th October 2017 |

| GSTR-6 (for Input Service Distributor) |

31st Dec 2017 |

13th August 2017 |

| ITC-04 (for job work) for quarter of Jul-Sep |

31st Dec 2017 |

25th October 2017 |

| TRAN-1 |

31st Dec 2017 |

30th September 2017 |

GST Rate Changes:

- 1% Composition Rate for manufacturers & traders

- 28% slab pruning cost to government = 20,000 Crore

- Restaurants within hotels [room tariff <7,500 - 5%] without ITC

- Restaurants within hotels [room tariff >7,500 ] still 18% with ITC

- Perfume, Shampoo, Tiles, Watches have been Reduced from 28% to 18% w.e.f. 15th Nov 2017

- Idli Dosa Batter, Desiccated Coconut, Coir Products have been reduced from 12% 5%

- Khandsari Sugar, Dried Vegetables, Duar Meal have been reduced from 5% Nil

- Wet grinders, tanks have been reduced from 28% 12%

- Refined Sugar, Diabetic Food, Condensed milk have been Reduced from 18% 12%

- 18% with ITC for Outdoor catering