Process for Filing Returns under GST- GSTR 3B, 1,2,3,4,5,6,7,8,9

Goods and Services Tax (GST) Act is a one of the biggest reforms in Indian Economy. GST is not only a tax reform but a ‘business reform’ which has impact on all business segments/constituents like manufacturers, traders, consumers, supply chain, IT system, logistics, etc. as well as Professionals and service providers. In nutshell, all these categories are at par under GST regime.

As we all are aware that under GST the main emphasis is on the seamless flow of credits and there should not be any break in the chain, therefore all the abatements and area based exemptions has been withdrawn on the onset of the GST Act. As per the latest announcement, Government has announced the sunset date for excise exemption granted to industries in North – Eastern and hilly states until 31st march , 2027, but it will be routed through "Refund Mechanism" only.

Now the question arises how this credit will flow seamlessly under the GST regime?

In order to have an unbroken chain of flow of credit the Return filing and the Matching concept has been introduced in the new law. Every registered taxable person [other than Specified Person*] to furnish a return electronically, for every calendar month, of

- Statement of Outward Supply {On or before 10th of next month}- GSTR-1

- Statement of Inward Supply {On or before 15th of next month}- GSTR-2

- Monthly Return {On or before 20th of next month}- GSTR-3

In addition to the above returns one annual return also to be filed for every financial year on or before 31st December following the end of such financial year. For example, for the FY 2017-18, the annual return must be filed on or before 31st December, 2018.

- “Specified Person”-

- Input Service Distributor;

- Non-Resident taxable person;

- Composition Dealer;

- Person liable to deduct Tax (u/s.51);

- E-Commerce operator for Tax collection at Source (u/s.52)

However for the initial two months i.e. for the month of July ’17 and August ’17, the Government has relaxed the norms by allowing a simple consolidated summary of all the Inward and outward supplies and the final tax liability in the format of a Form called GSTR – 3B in lieu of GSTR 1,2 and 3. However all these returns pertaining to the month of July and August 2017 will be filled in the month of September, 2017 and the details of the due date is given below:

| FORMS |

JULY 2017 |

AUGUST 2017 |

| GSTR3B# |

Before 25th/28th August’17* |

Before 20th September’17 |

| GSTR 1 |

1st - 5th September’17 |

16th - 20th September’17 |

| GSTR 2 |

6th - 10th September’17 |

21st- 25th September’17 |

| GSTR 3 |

11th - 15th September’17 |

26th - 30th September’17 |

* 25th August’17- File TRAN-1 later but cannot claim ITC of previous regime in this GSTR-3B.

28th August’17-File TRAN-1 and claim ITC of previous regime. Pay GST by 25th August’17.

# No buyer seller reconciliation needed

How to File GSTR – 3B?

Following steps need to be followed while filing the GSTR -3B:-

- After login, select Return Dashboard. Select Financial Year 2017-18 and Return filing period. Click Prepare Online under GSTR 3B tab.

- Declare your tax liabilities and eligible ITC claims in Table 3.1 and 4 respectively by clicking on the tiles and furnishing the required information.

- Enter details of interest, if payable, in Table 5.1. Late fee will be computed by the system

- Click on Save GSTR-3B. After you save the data, Submit button will get enabled. Please note that after submit, no modification is possible. Hence ensure that details are filled correctly before clicking on Submit button.

- On clicking Submit GSTR-3B button, System will post (debit) the self-assessed liabilities including system generated late fee in Liability Register and credit the claimed ITC into ITC ledger.

- After this the Payment of Tax tile will be enabled, please click it and declare your payment details to pay the taxes and offset the liability.

- Click CHECK BALANCE button to view the balance available for credit under Integrated Tax, Central Tax, State Tax and Cess. (This includes transitional credit also, if TRAN-1 is submitted). This will enable you to check the balance before making the payment for the respective minor heads. The balance is also displayed when the mouse is hovered on the applicable data entry field in payment section.

- Please fill out the section that specifies how you wants to set-off your liabilities using a combination of Cash and ITC.

- System checks if you have sufficient Cash/ITC balance.

- It also checks if the Reverse charge liabilities are set-off only through CASH.

- System also checks if all liabilities are set-off. Part payment is not allowed in GSTR-3B. Hence, ensure sufficient balance in Cash and ITC Ledger to Offset liability

- In case of ITC utilisations, the system checks the prioritization rules viz. IGST Credit has to be first utilised for paying IGST liability and remaining for CGST liability and thereafter SGST liability; SGST credit has to be first used for paying SGST liability and then IGST liability; CGST Credit has to be first used for CGST liability and the remaining for IGST Liability; SGST credit cannot be used for paying CGST liability and CGST credit cannot be used for paying SGST liability

- Transition ITC, if available in ITC ledger, can be used for payment of liabilities of GSTR 3B

- Click the OFFSET LIABILITY button to pay off the liabilities

- Click on declaration statement

- Select Authorized Signatory filing the Form

- Click on File GSTR-3B button with DSC or EVC

- Message for successful filing will appear and Acknowledgement will get generated.

Extension of Due Date for filing Form GSTR 3B for the month of July 2017

- The due date of filing FORM GSTR-3B is extended to 28th August 2017 vide Notification No. 23/2017-Central Tax dated 17th August 2017 only where the registered person is entitled to avail transitional credit and opted to file FORM GST TRAN-1 on or before 28th August 2017.

- In other words, in case registered persons planning not to avail transitional credit for discharging tax liability or new registrants who do not have any transitional credit will be liable to file GSTR 3B before 25th August’2017.

- In both the situations, the tax payable thereto should be deposited in cash on or before August 25’2017 otherwise Interest will be leviable.

The Government vide Press Release dated 17th August 2017 has stated that GST TRAN-1 will be available on the GSTN website from 21st August 2017.

Important*

Assessee who do not want to claim Transitional ITC in the July month return have the option to claim thereafter by filing GST TRAN 1 (within 90 days from the appointed date). Transitional Credit will only be available by filing GST TRAN 1 only.

Details to be furnished in Statement of Outward Supply (GSTR – 1)

GSTR 1 is the prescribe format regarding the details to be provided by the taxpayer in relation to outward supplies made to the buyer for the relevant period. GSTR 1 needs to be filed by every taxpayer except Composition Scheme taxpayers, Non Resident foreign taxpayers, TDS deductors, E- commerce operators and Input Service Distributors as there are separate returns for them. This return is required to be filed by the 10th of subsequent month. (Example: GSTR-1 for the transaction month of September has to be filed by 10th October). It has to provide following details:

- Invoice wise details of:

- inter-state and intra-state supplies made to registered persons.

- inter-state supplies with value more than Rs. 2.5 lakh to unregistered persons.

- Consolidated details of:

- intra-state supplies made to unregistered persons for each rate of tax.

- State wise inter-state supplies with value more than Rs. 2.5 lakh to a unregistered person.

- Debit and Credit notes issued, if any.

Details required to be furnished for the statement of Inward Supply (GSTR – 2)

As per law every registered taxable person is require to submit “Return for Inward Supplies” of both goods and services in GSTR 2. Adjustments, if any, is allowed to the seller in GSTR 1A in the succeeding month after the buyer has uploaded his GSTR 2. It should include the following details:

- Invoice details of all inter-state and intra-state supplies received from registered persons or unregistered persons,

- Import of goods and services made,

- Debit and credit notes, if any, received from the supplier.

Monthly Return (GSTR – 3)

GSTR-3 is a blend of FORM GSTR-1 and FORM GSTR-2, which is computer generated and gives the summary of total output tax liability, input tax credit and the difference is the tax liability for the month.

- Every such registered taxable person [other than Specified Person]

- to furnish a return electronically, for every calendar month, of inward and outward supply of goods and/or services , ITC availed, tax payable/paid

- on or before 20th of each month.

Note:

Monthly return cannot be filed if any previous tax return has not been furnished

- A registered person claiming refund of any balance in the electronic cash ledger may claim in PART-B of the return in FORM GSTR-3.

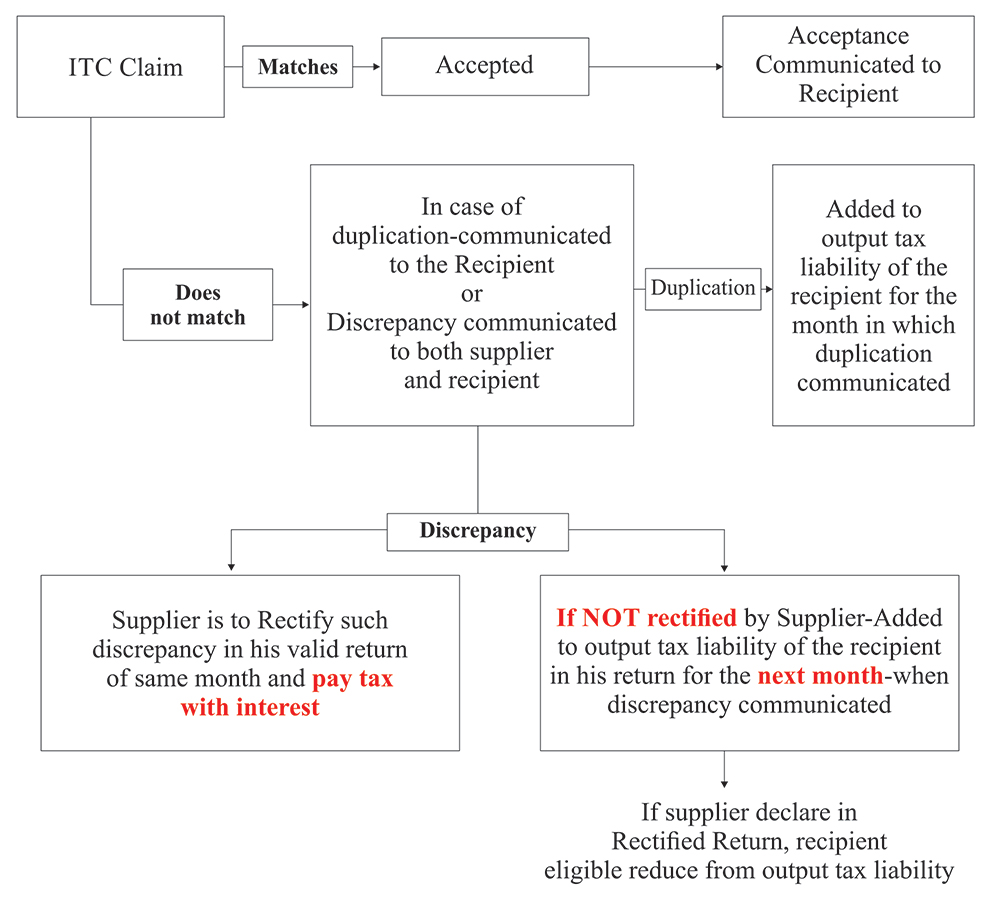

Details to be matched

- GSTIN of the Supplier

- GSTIN of the recipient

- Invoice/or debit note number

- Invoice/ or debit note date

- taxable value

- tax amount.

The procedure has been explained with the help of a flow chart for easy understanding-

Periodicity of Return Filing

| S. No. |

Registered Taxable Person shall Furnish |

To be filed by |

| 1. |

Return for outward supplies made by taxable person (other than ISD, Non-resident taxable person and a person paying tax under S. 10, S. 51 and S. 52) – GSTR -1 |

10th of the next month |

| 2. |

Return for inward supplies received by a taxable person (other than an ISD, non-resident taxable person and a person paying tax under S. 10, S.51 and S. 52) – GSTR -2 |

After 10th but on or before 15th of the next month |

| 3. |

Monthly return of outward supply, inward supply , ITC availed, Tax paid and Tax payable (other than an ISD, non-resident taxable person and a person paying tax under S.10, S. 51, S.52) – GSTR - 3 |

20th of the next month. |

| 4. |

Quarterly return for composition supplier – GSTR-4 |

18th day at end of quarter. |

| 5. |

Return for Non-resident taxable person- GSTR - 5 |

for every calendar month or part thereof, within 20 days after the end of calendar month or within 7 days after the last of period of registration |

| 6. |

Monthly return for Input Service Distributor – GSTR- 6 |

13th of the next month |

| 7. |

Monthly return for Tax Deducted at Source (u/s 51) – GSTR -7 |

10th of the next month |

| 8. |

Monthly return for TCS by e-commerce operator (u/s 52) – GSTR – 8 |

10th of the next month |

| 9. |

Annual Return - GSTR – 9 (Except Non Resident taxable person, Casual taxable person, ISD, Taxable person U/S 51 or 52) |

on or before the 31st December following the end of financial year |

| 10. |

Final Return - Every registered taxable person who applies for cancellation of registration (GSTR – 10) |

within 3 months of cancellation/ date of cancellation order (whichever later) |

Notice and Levy of Late Fee

- On failure to furnish the required returns, notice shall be issued to registered taxable person requiring him to furnish the return within 15 days.

- Late fee of Rs. 100 per day, subject to maximum of Rs. 5000/- if due date exceeded w.r.t. details to be furnished u/s. 37 and 38 or returns to be furnished u/s 39 and 45.

- Late fee of Rs. 100 per day, subject to maximum of 0.25% of turnover in the State/ UT, if due date exceeded for annual return.

This multiple rate tax structure is bound to bring in certain inefficiencies and pain points for the Assessee as well as for the tax departments. There are many uncertainties and confusions regarding the data to be incorporated under various heads in GSTR returns. For this we all have to learn with time and the clarifications issued by the Government on time to time basis. We may say that the proposed GST does simplify many things. From the current complex structure where tracking tax rate of a particular product throughout the country is a task in itself, we are going to see semi-automated returns, finalized tax credits, relief from the debate of taxability of transactions and many more.

One may conclusively state that these shifts from the ideal GST are necessary evils. In absence of these shifts, the entire proposal of having a GST might have failed. In such a scenario, many positives would not have surfaced, such as, improved flow of ITC, enabling business oriented decision making in movement of goods, greater inclusion of technology and systems based approach, improved checking of tax leakage, etc. These positives are bound to strengthen the economy in the long run.

Thus, even though changes have been made from the initial idea of ‘one nation one tax’ the same are for good and all states moving forward in complete unison is something unprecedented in the world’s largest democracy. Despite so many detours and amidst so many firsts, the trade can only hope for a smooth ride into the GST regime.

Authored By:

CA. ARCHANA JAIN

Member of "GS KAR SYS & Affiliates";

Ph: 9999009508, 8800091637;

ca.archanajain11@gmail.com, gskarsys@gmail.com