Impact of GST on Freelancers Impact of GST on Freelancers

Goods and Service Tax (GST) pools both the current Central and State Taxes into a solitary levy, thus eradicating the double taxation structure and empowering a joint nationwide market.

Source

It has had a tremendous impact on the diverse sectors of the Indian economy. One of the main sectors that it has affected is that of Freelancers. Freelancers are self-employed individuals working on multiple engagements under agreements on precise projects. They collect a bond payment for their work. As a freelancer is a service provider, thus all the GST rules and regulations are applicable to them too.

Basics of GST and Freelancers

Freelancers under GST providing taxable services are required to register compulsorily as per the GST guidelines if they exceed the exemption limit of GST for Indian Freelancers. Registration has to be done in the following situations:

- In case the turnover crosses the threshold limit of INR 20 lacs in general circumstances and of INR 10 lacs in specific circumstances of North-eastern states.

- For all services enclosed under Online Information and Database Access and Retrieval services (OIDAR), which include - advertising on the internet, providing cloud services, provision of e-books, music, movie, software and other digital goods or providing information to another person in electronic form through a computer network, online gaming, etc.

- For all service providers engaging in the interstate supply of service.

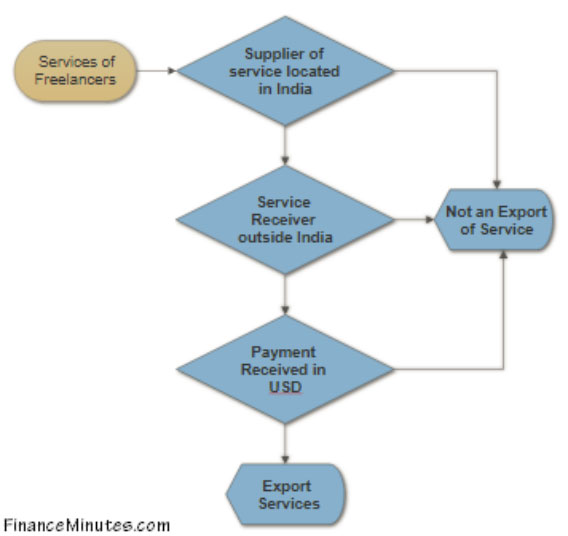

For all service providers engaging in an export of service. The GST on Freelance Work is 0%, 5%, 12%, 18%, and 28% - wherein, all the services are taxed as per the particular slab taxes. In case no particular slab rate is specified on a service, then 18% tax rate would be the applicable levy.

All invoices raised by a freelancer should be in accordance with the laws of GST for Freelance Writers. The invoice should contain all the necessary details including the name, address, GSTIN of the supplier as well as the recipient, SAC of services, date, value, and signature.

Source

Impact of GST on Freelancers

The GST Impact on Freelancers and the freelancing industry has been both positive as well as negative:

Positive Impact of GST on Freelancers:

As per GST guidelines, the GST Exemption Limit for Freelancers is applicable up to a turnover of INR 20 lakhs, this is positive for the freelancing industry as a majority of freelancers earn an annual income under 20 lakhs. Another one of the major positive effects of GST on Freelance has been the new-found eligibility criteria of freelancers –they are qualified to benefit from the credit of inputs held in store in circumstances where the service provider is moving from the exemption to the tax payable grouping.

Additionally, this tax credit can be operated for the expense of output GST liability in the future. The Input Credit of CGST/SGST/IGST paid at the period of buying of Input possessions as well as on Capital goods will be obtainable for Goods and Service Tax administration.

And last but not the least, the flowing consequence of service and VAT duties payable on selling of software by the freelancers- who provide online or offline software facilities is eliminated under the GST regime. This, in turn, has drastically reduced the price of software for the customers.

Negative Impact of GST on Freelancers:

The chief drawback of the implementation of GST for Freelancers is that not only are they required to pay taxes on the typical taxable services, but also on free services. In fact, all the services or supplies made are liable to be taxed under the GST regime.

Other than that, there is no existence of a centralized and unified registration system for freelancers having a number of office premises in diverse cities and states. Consequently, the freelancer service providers having multi-city premises have to register themselves again and again – from each state from where they are offering and/or delivering services. They are also required to pay CGST/SGST in all the state they are located in, separately.

Another negative impact of GST on freelancers is that the legitimate agreement burden is much greater under the GST regime as compared to the previous taxation system. Presently, if the gross revenue surpasses the threshold limit, then freelancers have to file numerous returns per annum from each and every location where the registration of their services has been granted, along with a mandatory audit by a registered Chartered Accountant.

Will GST Change the Indian Freelancing Sector?

While there are both negative and positive implications of GST on the Freelancing Industry, it has surely made the sector more organized. With GST being an evolving law, Freelancers can benefit in the long run as it aims to improve the Tax-GDP Ratio.