Stalemate over GST jurisdiction continues

Live mint

By Remya Nair

Sun, Nov 20 2016. 04 38 PM IST

Political consensus eludes centre, states over sharing of administrative powers even as the latter raises issue of demonetisation impacting revenue.

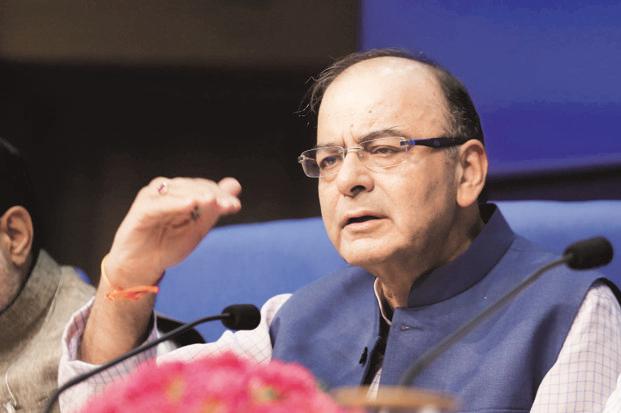

Finance minister Arun Jaitley said discussions will continue on 25 November. Photo: HT

New Delhi: The momentum for the implementation of the goods and services tax (GST) slowed on Sunday after the centre and the states failed to reach a political consensus over sharing of administrative powers in the new indirect tax regime.

In a meeting with Union finance minister Arun Jaitley, state finance ministers also raised the issue of the impact of demonetisation on states’ revenue, growth and the common man.

Sharing administrative powers for control over both goods and service taxpayers has remained a contentious issue. While states want exclusive control over small traders (those with an annual revenue of less than Rs1.5 crore), the centre is unwilling to cede complete control over such traders as it would leave a very small pool of taxpayers with the centre.

In the past few months, various formulations have been discussed and discarded by the GST Council. This forced the finance minister to look for a political consensus, albeit unsuccessfully, on Sunday.

“The meeting has remained incomplete. Discussions will continue on 25 November,” Jaitley said after the meeting.

One option that’s being considered is to divide the tax base horizontally, wherein taxpayers below a threshold of Rs1.5 crore are administered by the states and those above this threshold are divided between the centre and the states. But this is not favoured by the centre. The other option is to divide the entire tax base vertically, wherein the taxpayers are divided between the centre and the states in a fixed proportion.

Kerala finance minister Thomas Isaac said the meeting ended in a stalemate and a consensus was unlikely till the centre maintained a rigid stance. “The centre wants a fair share (of taxpayers to administer) but states consider it an unfair share. Kerala is unwilling to compromise. We have virtually given up our taxation rights. This is simply a question of administration. We do not want small traders with a revenue threshold of less than Rs1.5 crore to be under the centre’s control. Uttar Pradesh, West Bengal and Tamil Nadu also have similar views,” he said.

“Some states prefer a vertical split from top to bottom where two-third of the traders are controlled by the states and the remaining by the centre. Centre would also like to have a vertical split of all dealers. They are taking a rigid stance, but I hope good sense will prevail at the centre,” he added.

The estimated number of total active indirect taxpayers (including those paying value-added tax (VAT), service tax and excise) is around 10 million, of which around 400,000 are common to the centre and the states. This leaves around 9.6 million taxpayers, of which around 6.6 million are VAT assessees, 2.6 million are active service tax assessees and some 400,000 assessees are registered under excise.

But a majority of the 9.6 million tax assessees are below the annual revenue threshold of Rs1.5 crore. Only around 1.4 million assessees have an annual revenue of more than Rs1.5 crore. If this is divided equally between the centre and states, this will leave only around 700,000 for the centre to control.

“They are not fighting for sharing of work but for sharing of powers of coercion,” said a person familiar with the development.

The GST Council will now meet on 25 November to finalize the draft GST laws—the central GST (CGST) law, the integrated GST (IGST) law and the state GST (SGST) laws. Officials from the centre and the states will meet a day earlier to finalize the laws. The government hopes to table the CGST and the IGST laws in the winter session of Parliament to ensure a 1 April 2017 GST roll-out.

On the issue of demonetisation, many states have informally said they have seen a significant decline in revenues. “If 86% of your money disappears, there is a problem for people. There is a collateral impact on investment sentiments,” said Isaac.