Stage set for July 1 rollout: GST Council caps cess on luxury goods at 15%

Business Standard

By Dilasha Seth & Indivjal Dhasmana

March 17, 2017. 08:33 IST

All five Bills cleared, paving way for new indirect tax regime roll-out from July 1

Union Minister for Finance and Corporate Affairs Arun Jaitley talks to West Bengal Finance Minister Amit Mitra and Puducherry CM V Narayanasami at GST Council Meeting, at Vigyan Bhawan in New Delhi (Photo: PTI)

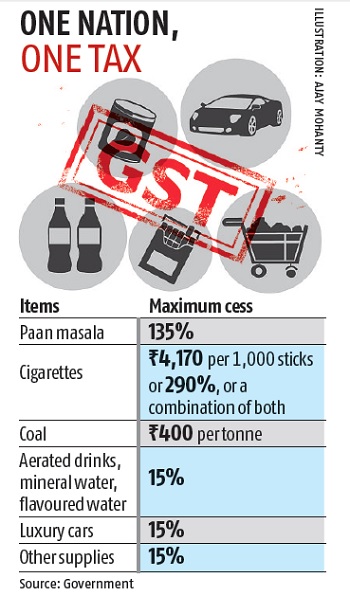

The Goods and Services Tax (GST) Council on Thursday cleared a proposal to cap the cess on luxury cars and aerated drinks at 15 per cent over the peak rate of 28 per cent. The ceiling for the cess on “sin” goods would be much higher.

An official said for paan masala, the cap would be 135 per cent. On tobacco and cigarettes, the cap would be 290 per cent, or Rs 4,170 per 1,000 cigarette sticks. A call is yet to be taken on whether or not a cess would be imposed on bidis. The cess on coal and lignite (environment cess) would have an upper limit at Rs 400 per tonne, the official said.

However, the actual cess would be much lower — equal to the current indirect taxes on these goods. The cap would give headroom to the authorities to increase the cess in the future.

After the meeting of the Council in New Delhi on Thursday, Union Finance Minister Arun Jaitley explained at present, luxury cars were taxed at 40 per cent. After the GST is rolled out, luxury cars would be taxed at 28 per cent, and a cess of 12 per cent more would be charged.

The Council gave a cushion of 25 per cent in the case of paan masala, the official said. In the case of cigarettes, there was inbuilt headroom of 100 per cent, as either or both ceilings could be imposed.

Currently, the tax on cigarettes is a mix of ad valorem (on estimated value of goods being taxed) and a specific tax. While the value-added tax (VAT) is ad valorem, excise is a mix of ad valorem and specific tax. “We will most likely use a combination of both. For instance, 50 per cent ad valorem and 50 per cent specific, so there are no leakages,” the official said. The environment cess had no cushion, as the industry could not bear more than that, he added. The cess would be used to compensate states for any loss in revenue because of the GST. The cap on cess on any other items notified later would be used only if more compensation is needed; so, in a way, this was also a leeway.

The official said if it was found the compensation amount was higher than anticipated by the government, then the GST rate on an item could be reduced to, say, 26 per cent and cess increased to 14 per cent, so that the aggregate rate remained equal to the current rate (40 per cent). Jaitley said four of the Bills — state GST (SGST), Union Territory GST, and changes to the central GST, integrated GST and compensation legislation — cleared on Thursday would be taken to the Cabinet expeditiously. Then, these would be presented in Parliament.

SGST Bill would be taken up by the respective state Cabinets and assemblies so that the GST could be rolled out from July. Jaitley said there would be a time buffer to prepare for the GST roll-out, and July was a tentative date.

Saloni Roy, senior director, Deloitte Haskins & Sells LLP, said, “All steps by the GST Council so far indicate they are moving towards a July 1 roll-out.”

Saloni Roy, senior director, Deloitte Haskins & Sells LLP, said, “All steps by the GST Council so far indicate they are moving towards a July 1 roll-out.”

The Council also cleared a Union commerce department proposal for the nil rate to be applied for goods and services going to special economic zones. Now, the Council will work out rules on composition, valuation, tax collected at source and transitions. It has already approved rules on refunds, invoices, returns, payments and registration. In the next meeting on March 31, the Council will take up the rules on four categories and any changes to the already cleared rules on five issues.

A committee of officers would then work out the fitment of rates for various items. The Council has already approved four rates — 5, 12, 18 and 28 per cent — besides the nil rate.