Government delves into etailers’ concerns on GST

The Economics Times

By Deepshikha Sikarwar , ET Bureau

Aug 22, 2016, 01.50 AM IST

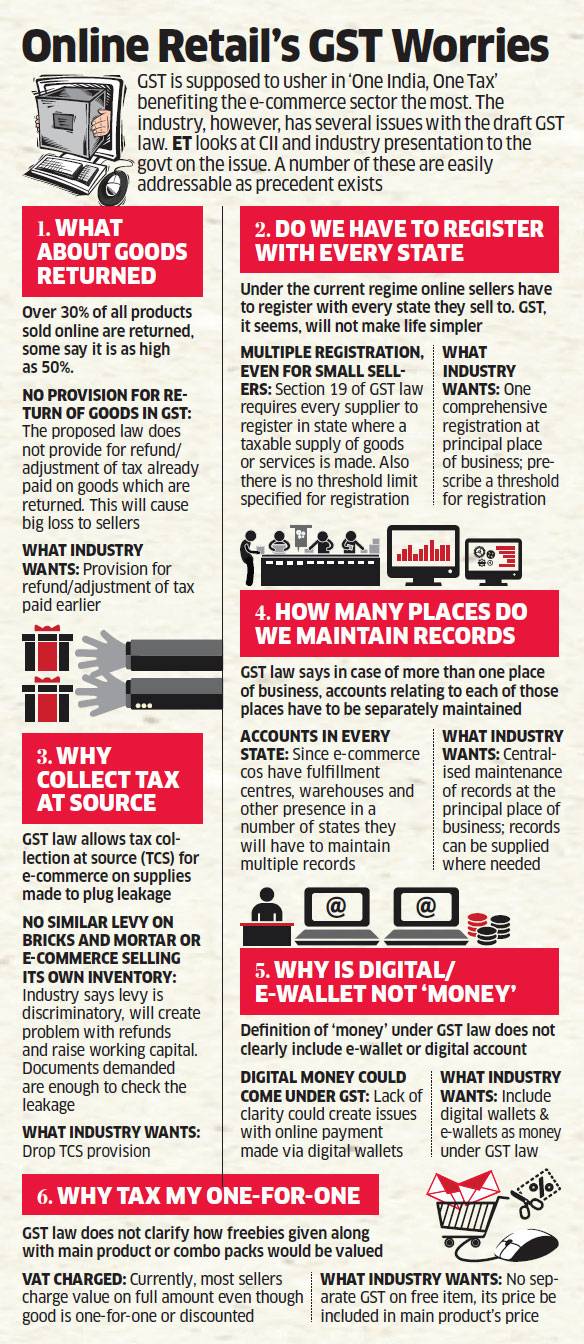

NEW DELHI: The government is looking into the biggest concern of online retailers with the goods and services tax (GST) — rules relating to returned goods that have at times even reached as high as half their sales.

NEW DELHI: The government is looking into the biggest concern of online retailers with the goods and services tax (GST) — rules relating to returned goods that have at times even reached as high as half their sales.

The draft GST law does not provide for credit on tax paid on returned goods, potentially imposing double taxes on sellers — tax paid on returned goods and again when replacements are provided. GST may be put in place as early as April 1.

The industry also fears return of the permit raj, with the law allowing states to seek additional documents from transporters carrying goods exceeding Rs 50,000.

"Industry probably prefers more clarity as the term 'sales return' has not been used," said an official, adding that it could be examined. Online sale returns average around 30%, but in India this can be as high as 50%.

The GST law, however, does not provide for any refund or adjustment of tax already paid on goods returned by customers.