No decision yet on GST rates as States oppose cess

Business Standard

October 20, 2016 02:29 IST

Council to meet again on November 3-4 to finalise the tax structure; “Structure can be finalised after consensus is reached on funding for compensations”.

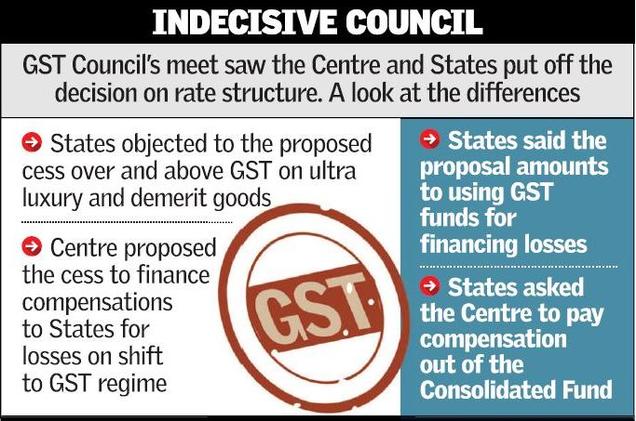

The GST Council’s third round of deliberations ended here on Wednesday without a decision on the rates structure after most States objected to a proposal to levy an additional cess on demerit goods.

Triggers objections

The proposal from the Centre that triggered objections was for the imposition of a cess over and above the Goods and Services Tax on ultra luxury and demerit goods such as big cars, aerated beverages and tobacco products.

Finance Minister Arun Jaitley told a media conference that the GST Council — comprising Ministers from all the States and headed by him — will meet next on November 3-4 to decide on the GST rates structure.

The Centre had on Tuesday proposed the cess as a means to finance the compensation it will have to pay States.

“While the modalities for calculating the losses were agreed, by consensus, in the Council, there was no agreement on the funding mechanism the Centre proposed,” Revenue Secretary Hasmukh Adhia told reporters after the conclusion of the discussions.

Separately, the Centre’s proposal on the GST rate structure retains only the Clean Environment Cess, with the GST to subsume the rest (a move backed by the States), Mr. Adhia said.

“A number of States objected to the use of GST collections (cess on GST) to finance GST compensations,” a member of the Council later told The Hindu.

He said the dissenting States demanded that the Centre fund the compensations out of the Consolidated Fund of India instead of tax revenue mopped up from the GST system. “Just like compensation to States were paid for losses arising out of the shift to the VAT (Value Added Tax),” he said.

Finance Minister Arun Jaitley told reporters: “We will finalise the tax structure at the next meeting… it can be frozen only after deciding whether compensation to States is to be funded out of the rate structure itself or from some special cess or some third source.”

Mr. Adhia said the members had sought time for discussing with their State governments the four-slab rate structure, ranging from zero to 26 per cent, the Centre has proposed. “The Council will be able to finalise the GST rates structure after consensus is reached on the funding mechanism for compensations,” he said.

If instead of the proposed cess on GST, simply the rate of the GST on demerit goods is raised, as suggested by some States, then, the GST rate structure would end up with a multitude of tax slabs, Mr. Adhia explained.

For example, he said, the current rate of incidence of taxes may differ for aerated beverages, cigarettes, bidis and luxury cars.

“If you have to put each in rate structure, one challenge is how many slabs can you have then… Can you have 26, 45, 75 per cent slabs? There are commodities where the effective rate of taxation currently is more than 100 per cent. Now the question is, is it feasible to have so many slabs of taxation in GST,” Mr. Adhia said.

The Council could not discuss the proposed GST rate of 4 per cent for gold, he said.