GST: Citing demonetisation, states demand higher compensation

Live mint

By PTI

Tue, Jan 03 2017. 08 31 PM IST

Coastal states pressed for rights to levy GST on trade of goods within 12 nautical miles offshore, holding up finalising of the draft law for levy of IGST on inter-state trade.

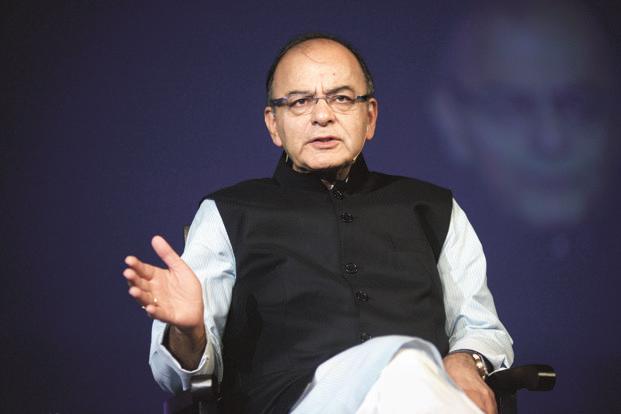

Union finance minister Arun Jaitley.

New Delhi: In fresh roadblocks to tthe goods and services tax (GST) rollout, states on Tuesday demanded taxation rights for sales in high seas and also increasing the number of items on which cess is to be levied to compensate the states to deal with revenue loss estimated at Rs90,000 crore post demonetisation.

Initially a Rs55,000 crore GST compensation fund was proposed to be created by levying cess on demerit or sin goods and luxury items, but after demonetisation the compensation amount is expected to go up to Rs90,000 crore as most states have seen revenue decline of up to 40%, non-BJP ruled states claimed.

Also, coastal states pressed for rights to levy GST on trade of goods within 12 nautical miles offshore, holding up finalising of the draft law for levy of Integrated-GST (IGST) on inter-state trade. At the eighth meeting of the all-powerful GST council, TMC-ruled West Bengal, CPM-led Kerala and Congress-ruled Karnataka pressed for including area up to 12 nautical miles in the definition of states within IGST law, a standoff that led to chairman and Union finance minister Arun Jaitley agreeing to seek legal opinion on its Constitutional validity.

“We couldn’t reach a consensus on a very important issue that relates to defining of a state. This is 12 nautical miles from the state. Can states charge GST from them or not? Right now states like Gujarat, Karnataka, Kerala, Maharashtra, West Bengal and Odisha are charging VAT or sales tax within 12 nautical miles.

For e.g. when a ship is loaded with oil or products, the tax on that is charged by the states. “All the coastal states, irrespective of parties, combined in saying that we must have 12 nautical miles within the state jurisdiction. Whereas the draft IGST law was looking at having taxation rights with the Centre,” West Bengal finance minister Amit Mitra told reporters.

The Day 1 of the panel meeting did not take up the contentious issue of control of assesses which had been till now holding up roll out of goods and services tax (GST) regime. The issue would be discussed on Wednesday.

While representatives of opposition-ruled states were unanimous in saying 1 April target date for rollout of the new regime is not possible, even BJP-ruled Gujarat said GST could become a reality from September.