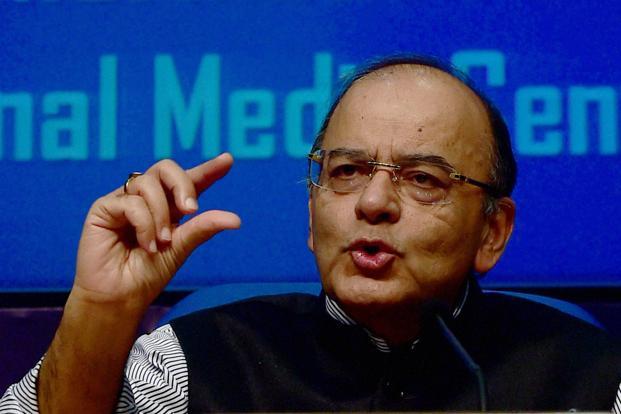

Efforts on to build consensus on sticky GST issues: Arun Jaitley

Business Standard

By Press Trust of India

November 10, 2016. 15:28 IST

Govt has covered a lot of distance for implementation of the GST and it doesn't want to resort to voting to decide on any issue at the Council meeting, says FM.

Finance Minister Arun Jaitley on Thursday said the Centre is making all efforts to build consensus on sticky issues, especially on jurisdiction of assessees, to ensure GST rollout from April 1, 2017.

"We are making all efforts to introduce GST from April 1, 2017. GST has to be implemented latest by September 16, 2017, and if it is not implemented by then, then states will not be able to collect their share of taxes, and hence there is not enough scope to further delay the decision," he said.

Inaugurating the two-day Economic Editors' conference, Jaitley said the government has covered a lot of distance for implementation of the Goods and Services Tax (GST) and it doesn't want to resort to voting to decide on any issue at the GST Council meeting.

"We have already sorted out 10 issues. The issue of dual control still remains, there is no reason why we will not be able to work out a reasonable solution on this," he said.

The all powerful GST Council, which is chaired by the Union Finance Minister and has representations from state, has already decided on a four-tier rate structure — 5, 12, 18 and 28% — with a cess over and above the peak rate for luxury and demerit goods.

"One of the objects has been that, since the GST council is a federal decision making process and the manner in which it functions in the initial years will lay down the precedent for the future rather than resorting to voting and division in every small issue. We have been trying to discuss, re-discuss and then reach a consensus and so far most of the major issues we have been able to resolve through consensus," Jaitley said.

The issue of dual control, which deals with who will control which set of assessees under GST, has been holding back the negotiations. Jaitley and his state counterparts will meet on November 20 to work out a "political solution" on the issue and the GST Council will formally take up the issue on November 24-25.

"Only the last stages (of decision making) remain and I do hope we (GST Council) are able to resolve that through a larger consensus also. And this form of functioning of the Council where discussion and consensus is a preferred option, is a precedent we are trying in a federal decision making body to establish," Jaitley said.

He added that reforms are going on in the direct tax structure and other areas. "If you have seen from the Insolvency Bill to the GST and now the decisions in the GST Council, our preferred option has been consensus and we hope to utilise that preference itself," the Finance Minister said.

As per the GST Constitution Amendment Bill, which was notified on September 17, 2016, the government is required to complete the process of implementation of GST within a year.