GST rates: Trust deficit between Centre, states widens

Live mint

By Remya Nair

Mon, Oct 31 2016. 09 52 AM IST

With both the Centre and states hardening their stance, time is fast running out for the GST council to finalize the rates amid govt’s bid to implement the tax reform from 1 April.

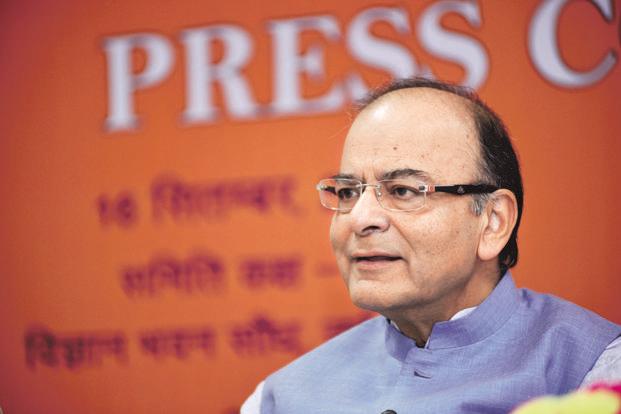

Union finance minister Arun Jaitley, during a media briefing last week, defended the government’s proposal of a multi-tiered rate structure and a cess. Pradeep Gaur/Mint

New Delhi: In an indication of the growing trust deficit between the Centre and the states ahead of the crucial meeting of the Goods and Services Tax council on 3-4 November, both sides are hardening their stand on the tax rates and structure under this ambitious tax reform.

Over the past one week, both sides have sparred in the media to reiterate their rigid stance on the tax rates and slabs.

While last week Union finance minister Arun Jaitley met editors of prominent publications and television channels on GST over a cup of tea and followed it up with a Facebook post last week defending the government’s proposal of a multi-tiered rate structure and a cess, Kerala finance minister Thomas Isaac wrote about his misgivings on the Centre’s proposal in a column in the Indian Express.

The Centre has proposed a multi-rate structure wherein gold will be taxed at 4% and the rest of the items at a tax rate of 6%, 12%, 18% and 26%. It has also proposed to levy an additional cess over and above 26% on demerit items like tobacco, luxury cars and aerated drinks and use these proceeds to pay compensation to states for the revenue losses arising due to GST, if any.

Jaitley in his post batted for “continuation of existing levies as cess for a period of five years before subsuming them as tax. This would include clean energy cess and cesses on luxury items and tobacco products, which in any case, presently also pay levy higher than 26%. This would ensure no additional burden on the tax payer and yet be able to compensate the losing states.”

It is this cess as well as the highest slab of 26% that has emerged as the point of contention between the centre and the states. States are opposing the levy of cess arguing that the centre cannot deprive states of their rightful share of GST revenues and then use that amount to pay them compensation. They are also favouring a higher slab of around 28-30% arguing that items like consumer durable are already taxed at 27-34%.

“The most controversial is the upper rate of 26%. The commodities included in the higher bracket currently suffer 14.5% VAT (value added tax) and it makes no sense to reduce the SGST (state GST) to 13%. Besides, these commodities suffer Central excise duty of 16% and above; commodities such as SUVs attract excise rate as high as 34%. There are other taxes currently subsumed under the GST such as octroi, entry tax, cesses and service tax. Besides, one has also got to account for the cascading impact of tax prevalent in the existing system. The logic of reducing the tax incidence on consumer durables and demerit goods to 26% makes the GST severely regressive,” Isaac wrote in the Indian Express voting for the 26% rate to be increased to 28%.

“The chief economic adviser’s report had recommended the demerit goods rate of 40 per cent. It should be reintroduced in the structure and the states should be given flexibility in determining the demerit goods,” he added.

Isaac also strongly opposed the Centre’s proposal to levy a cess compensate states.

“The upper rate has been pegged at a lower rate so that the Central government has the option to impose the cess as and when necessary — of course, with the concurrence of the GST Council. This is not acceptable to the states. They are being deprived of their legitimate revenue so that compensation can be mobilized by the Centre,” he said.

The sharing of administrative powers between the centre and the states is also back on the drawing board with both sides unable to arrive at a consensus on how to share dealers.

With both sides maintaining their hard stance, it will now be a race against time for the GST council to finalize the tax rates as well as the supporting legislations within the next three weeks. The government is targeting to implement GST from 1 April 2017 but for that has to get the central GST law and the integrated GST law passed in the upcoming winter session of Parliament.